.svg)

.svg)

.svg)

.svg)

SafeTransact: The only Pre-transaction Crypto Compliance Platform

Pre-transaction decision-making in real-time, at scale. Our privacy-preserving platform allows you to approve transactions at scale in real-time. Proactively identify and stop high-risk activity before it occurs, ensuring the safety of your business.

Powering compliant transactions for

.webp)

.webp)

Why Notabene

Streamline Counterparty Verification with Notabene: The Bank-Grade Solution for Financial Institutions and VASPs.

10,000+

Assets

supported

1000+

VASPs in our Open Network

200+

Wallets

supported

120+

SafeTransact customers

20+

Jurisdictions supported

Comply with pre-transaction requirements in real-time with Notabene

Identify and stop high-risk activity before it occurs.

Step 1

Identify & screen all counterparties

Automatically qualify, classify and screen transaction data by leveraging multiple compliance tools in one place

Step 2

Perform VASP due diligence & assess risk

Access and analyze verified data about your counterparties

Step 3

Exchange travel rule information

Connect with your counterparties via the Notabene Network and top Travel Rule protocols

Step 4

Automate TX flow and analyse insights

Manage compliance workflows and access metrics, insights and reporting tools

SafeTransact Features

Notabene’s SafeTransact provides a holistic view of all of your crypto transactions. Our fully integrated suite of tools helps you perform real-time decision-making by automating:

- Travel Rule compliance in line with your local regulation

- Counterparty sanctions screening

- Self-hosted wallet identification

Travel Rule Compliance

Self-hosted Wallet Identification

Case Management Dashboard

Analytics and Reporting

VASP Due Diligence

Sanction Screening

SafeAutomate

SafePII

SafeGateway

Pre-transaction decision-making in real-time at scale.

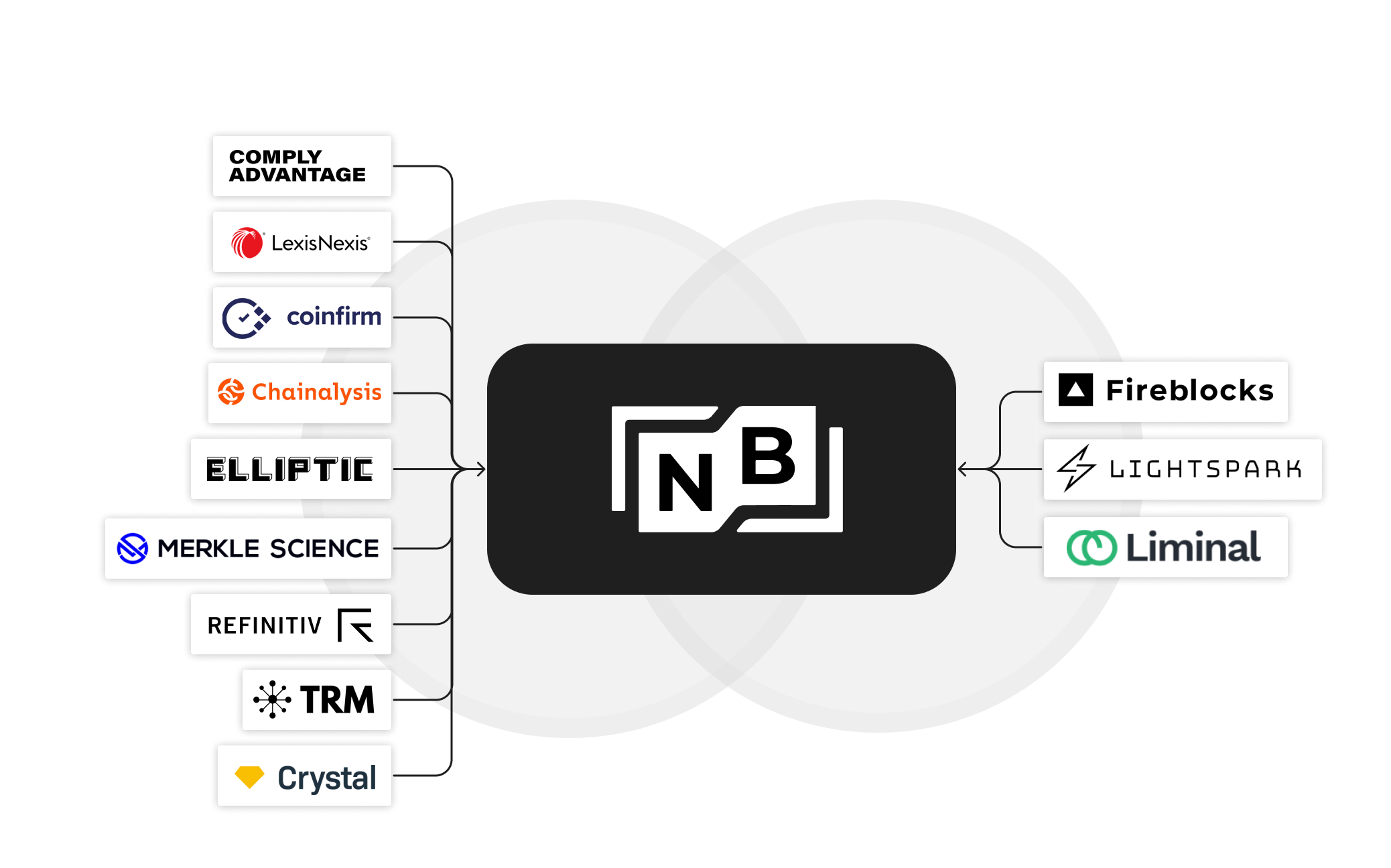

A connected ecosystem with best-in-class partners

TECHNOLOGY

SCREENING

"As the world embraces the rapid advancement of Web3 and digital assets, we need to ensure our solutions strike a balance between regulatory compliance and the inherent agility of this fast-paced technology sector. By partnering with industry-leading digital asset compliance solutions like Notabene, we are empowering our customers to navigate complex compliance requirements across multiple jurisdictions with ease."

Jason P. Allegrante

Chief Legal & Compliance Officer, Fireblocks.

Ensuring Your Privacy and Security:

Our Commitment at Notabene

Bank-grade security at every layer

- Cloud and Infrastructure best security practices

- Realtime Security Vulnerability Checks before code release

- All sensitive data is encrypted, at rest and in transport, using battle-tested encryption schemas

- Multiple regions for data storage are available. Full physical data segregation is available for Enterprise customers

Industry’s strongest protection for your customer data

- SafePII. The industry’s only escrowed exchange of encrypted PII

- Compliant with EU GDPR, Singapore PDPA

- Plug-and-play Travel Rule end-user data consent component

Enterprise Ready

- 24/7 uptime

- Configurable enterprise SLA

- SOC2 Type II compliant

- Enterprise-ready authentication mechanisms available

Join the

Notabene Network

Connect to our global VASP ecosystem. Perform trusted transactions with over 1000+ crypto companies and financial institutions.

Become a trusted partner to VASPs globally.

Build a rich VASP profile and enhance your reputation as a compliant VASP. Set up your multi-entity structure to adopt a globally-compliant approach.

Gain real-time insights into your top counterparties.

Access over 1,000 VASPs’ incorporation, regulatory and Travel Rule information. Automate due diligence and establish trusted relationships with top counterparties.

Overcome the Travel Rule’s ‘sunrise challenge*

Send and receive data transfers from/to any of your counterparties, even if they don’t have a Travel Rule solution in place yet.

Two packages tailored to your risk-based approach.

FAQs

Crypto Compliance

In order to fully comply with the FATF’s Travel Rule, VASPs are required to perform multiple pre-transaction compliance checks to ensure that the transaction details satisfy the compliance process put forth by the VASP’s compliance team.

Notabene's SafeTransact offers unique benefits for FATF compliance. It stands as the only solution available for pre-transaction decision-making as mandated by FATF's Interpretive Note 15-7b. With the first 'protocol-agnostic' design, it enables secure data exchange across an expansive network of 400+ VASPs worldwide. Additionally, it resolves limitations of closed networks, through a unique Travel Rule protocol agent, offering standardized connections across different protocols.

The Financial Action Task Force (FATF) is an inter-governmental global anti money laundering and terrorist financing watchdog founded in 1989. The FATF sets international standards aiming to prevent illegal activities and financial crime. In October 2018, the FATF adopted changes to its recommendations to explicitly clarify that they apply to financial activities involving virtual assets.

Global money laundering and terrorist financing watchdog, the Financial Action Task Force (FATF), issued guidance for the virtual asset industry in June 2019, including Recommendation 16, known in the industry as the Crypto Travel Rule. The Crypto Travel Rule requires virtual asset service providers (VASPs) worldwide to send and store information surrounding the parties of a transaction.

Future business opportunities after complying with the FATF Travel Rule are immense. FATF Travel Rule compliance presents the most significant opportunity for virtual assets to become widely accepted in everyday use cases. Cryptocurrency companies that comply will have better access to traditional banking, which will allow easier access to institutional investors. They will also be able to provide more visibility and trust around each transaction for their customers.